Module 6: Credit Card on File

Introduction

When you were a kid, did you ever dream of being a superhero? Swooping in with your superpowers to save the day? Maybe you dreamt of flying, or having X-ray vision, or having superhuman strength. It was fun letting your imagination run wild, wasn’t it? But that was kid stuff -- grown-ups are too mature for that kind of thinking, right?

Well . . . not really. Truth be told, most of us still dream of swooping in to save the day, and at your allergy practice, doctors and nurses use their superpowers every day -- stopping an asthma attack in its tracks, knocking out allergies left and right.

But they’re not the only ones who can save the day! You can break the chains of collection worries for your practice and knock out late patient payments caused by high-deductible health plans. Wouldn’t that be amazing?

How can you do this? With the help of a powerful device: a credit card on file program. With this, you’ll be able to work wonders for your practice. You’ll be able to shrink administrative expenses, knock accounts receivable time down to size, and magnetically draw back money floating away as bad debt.

Are you intrigued? Good! Then in this module we’ll...

- Review current practice collection problems.

- Explore how a credit card on file program works.

- Discuss security and technology considerations.

- Go over staff training.

- Highlight the importance of communicating the policy to patients.

Let’s get your superpowers activated!

The Villain in the Shadows: Practice Collection Problems

What makes collecting payment from our patients such a menacing problem? Does it only happen to certain practices? Are we doing something wrong?

Not at all. This is a dilemma that everyone in the medical field is experiencing, from the smallest practices to the largest hospitals.

And here’s why.

A huge issue nowadays is collecting payment from patients who have high-deductible health plans and those who are self-pay.

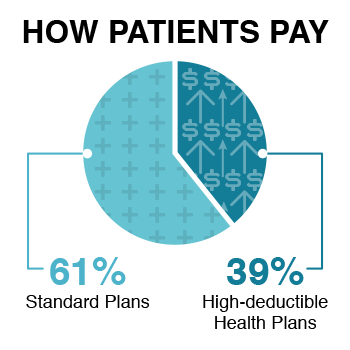

According to a study done by the CDC’s National Center for Health Statistics, the percentage of patients with a high-deductible health plan has leaped from 26.3% in 2011 to 39.3% in 2016. And the annual deductible for an individual is around $1,300; for a family, it’s around $2,600.1

That’s a lot of money for patients to come up with before their insurance kicks in (that is, if they have insurance).

Additionally, the percentage of high-deductible health plans is only expected to increase. Employers love them, and a recent survey of 600 U.S. companies by Willis Towers Watson found that, by 2018, nearly half of employers will no longer offer any other type of health insurance.2

So, money is stretched tight for many of your patients -- especially with such a sizable chunk of their budgets now having to go to health care costs when it didn’t used to. It’s no wonder that they sometimes make choices that leave your practice out in the cold. The reality is, collecting payment has become an increasing problem for practices.

Have you been experiencing longer collection times when it comes to getting payment from your patients? If so, think of your situation this way: Every day your practice goes unpaid is a day you’re lending money to patients -- and interest-free! Ouch!

Let’s look at how a credit card on file program can rescue your practice from the fiendish problem of lost revenue.

The Secret Formula of a Credit Card on File Program

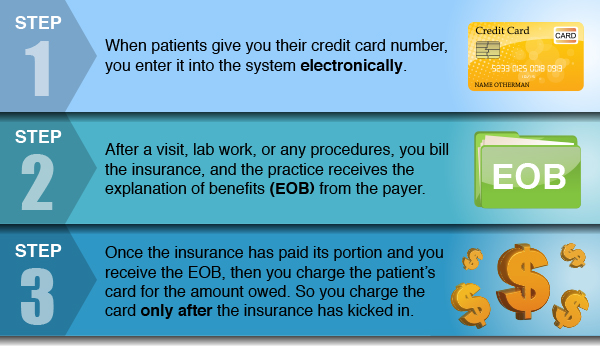

How exactly does a credit card on file program work? It’s a very simple formula (and not really secret). To start with, you’ll have patients provide you with a credit card, debit card, or health savings account (HSA) card number when they check in for an appointment. Here’s an overview of the basic steps you’ll take:

Can you see how much this will improve your collection time? In most cases, this time is reduced to between 32 to 45 days. You bill the insurance, receive their payment, charge the patient’s credit card for the remaining balance and then send the receipt to the patient. It can be that simple and streamlined.

The collection headaches for your practice are reduced, as is the time your staff must devote to this unpleasant process. Gone are the costs of sending multiple statements to patients about their outstanding balance. Instead, your practice only needs to send one receipt when the charge is complete.

So that’s the big picture of how a credit card on file program works. To make it a success, you’ll need to implement plans in three key areas:

- Security issues

- Staff training

- Patient communication

Let’s examine each of these next.

Keeping Information Safe and Secure

A successful credit card on file program is a secure one! You must do everything you can to keep your patients’ credit card information safe. How can you achieve this? It’s essential that you do two things:

- Adhere to secure technology practices.

- Create a strong security policy.

Let’s devote some time to each of these.

Secure Technology Practices

Securely storing your patients’ credit card information is crucial. And here’s the first thing you need to know: You absolutely do not store this information in your practice!

Do not store your patients’ credit card information in your practice!

Why? Because this puts your practice at risk and could make your patients’ financial information more vulnerable to being hacked.

Instead, use a third-party credit card processor -- housed off-site -- to store patient credit card information. This not only keeps your patients’ information private and safe, but it also transfers the risk to the merchant service, since they will be responsible for keeping the information secure.

If you have a practice management system (PMS), make sure you choose a credit card processor that can connect to it. That way, your staff can enter in credit card information, and it will automatically be stored in the third-party database.

As another option, some PMS’s are now offering built-in functionality for storing and processing credit cards -- without requiring you to subscribe to another service. Be sure to look into this option.

Action Step!

Find out what companies your PMS partners with for credit card processing -- or whether they offer this service themselves. Also, research what services each vendor provides (email receipts to patients, reports, etc.)

So that’s the technology aspect. Next, let’s look at what to include in a security policy for your practice.

Create a Practice Security Policy

Once you have the technology secured, it’s time to create a security policy for protecting credit card information and then train all your staff on it. You need to start with two essentials:

- Make sure all your staff knows not to photocopy any credit cards or write the information on paper. Rather, your team should directly enter it into the online system. (If you do allow them to make any paper copies, make sure they shred the information immediately after they enter it.)

- Make sure every user of the payment gateway has an individual logon and password, and change those passwords every 90 days.

Bottom line: Don’t keep copies of credit card information at your practice at all, and guard access to your payment gateway like a hawk! (For more security policy ideas, check out Payment Card Industry Security Standards for Vendors3.)

Okay, now you’re armed with some key strategies for safeguarding your patients’ credit card information. Your next step is to create your practice’s credit card on file policy, which explains the nuts and bolts of how you want this to work.

Creating Your Practice’s Credit Card on File Policy

The next step to implementing a credit card on file program for your practice is to develop a policy for how you want to do it. Here are some key actions to include:

- Have your patients sign a credit card authorization form giving your practice permission to charge any balance the insurance company does not cover.

- Continue to charge copays at the time of service. You can also continue to charge deductibles at the time of service, if that’s something you’ve been doing.

- For payment plans, you can arrange to charge patients monthly. In fact, you may want to require patients on payment plans to participate in your credit card on file program.

- Decide whether you’ll email an invoice to the patient (or send it via portal or mail) after you receive the EOB to let them know about their remaining balance. Some vendors will provide this capability.

- Determine how quickly you will charge patients after you receive an EOB. Some EOBs have errors, and you want to avoid patients getting charged a large incorrect balance. Ideally, you should give the patient a chance to review the EOB for accuracy before you charge them. Some practices give patients 30 days to review the EOB before charging their credit card, and others limit the review period to 10 days.

- Decide whether you’ll email an invoice to the patient (or send it via portal or mail) after you receive the EOB to let them know about their remaining balance. Some vendors will provide this capability.

- Figure out how you’ll notify patients after you’ve charged their credit card. Will you send an email, a portal message, or notice via regular mail? Again, some vendors will provide this service.

- Nail down whether and how you’ll handle exceptions. Some practices don’t require patients to participate -- but only if they pay their expected balance up front instead. (What do you do if a patient refuses to take part in this program? Don’t worry, we’ll discuss that shortly!)

- Decide how you want to implement this program -- all at once or gradually. It may make sense to implement the program in stages, starting with patients in payment plans first.

Your policy doesn’t need to be long and involved -- succinct, clear and to the point is what you want. But a policy doesn’t do any good if your staff isn’t trained in it, so let’s look at the crucial role of training next.

Training Your Staff

The best-laid plans of any superhero are bound to go haywire if your team isn’t completely equipped and on-board. It’s crucial you train your staff before you try to implement this change.

Your staff will be explaining this new program to your patients, so they need to see its value in order to show patients the benefits. Also, they need to understand your policy inside and out because they’ll be walking patients through it.

Help your staff UNDERSTAND your policy

so they can ARTICULATE it clearly to patients.

So that’s the why of the training.

Next, here are some tips for what to include in your training.

As you know, asking patients for payment is awkward -- so asking them to participate in a credit card on file plan can be even more challenging. To overcome this obstacle, you need to help your staff get comfortable with it.

Two effective ways to do this are...

- Provide scripts for all staff who answer the phones and check in patients.

- Role-play with your staff to get them comfortable. You’ll want to emphasize why you’re doing this and how it works.

Once your staff is thoroughly trained and comfortable explaining the program, it’s time to communicate this new policy to your patients.

Communicate the New Policy to Your Patients

You don’t want to just spring a brand-new credit card on file program on your patients when they come in for their appointment. They need time to think about and accept this new policy, so it’s best to notify them ahead of time.

Start off by sending a letter or an email to your patients that explains the policy, as well as the security measures your practice is taking to protect their information. Then have additional copies on hand for patients at check-in. Here’s a sample letter, which you can customize. It’s also in the Resources section of this module for your convenience.

Then, create a list of FAQs and post these and your credit card on file policy on your website. You’ll also want to have copies in print available when patients check in.

Beyond the mechanics, you’ll always want to make sure you explain the benefits of the program to patients! This will help them see the value in it for themselves and want to get onboard with the new program. Here are some of the benefits to highlight:

- There’s no need to write a check, go online to pay, or wait for a statement.

- You don’t need to bring payment to the visit.

- It’s more secure -- the staff only sees your credit card once when they place it on file, rather than at every visit.

- You get quicker refunds for overpayments. Your credit card is credited right away, so you no longer have to wait for someone to issue a check.

- Collecting money the practice is owed helps keep the practice viable and seeing patients.

- Your card will be charged only after the explanation of benefits arrives. It’s insurance first, then credit card.

- You will have a chance to review your EOB for accuracy before your credit card is charged. (It’s important to remind your patients that the insurance company decides the amount they’ll be charged, not your practice.)

Even if you do everything right -- get secure technology firmly in place, create effective policies, thoroughly train your staff and clearly communicate the how-to’s and all the benefits -- you’re likely to encounter some patients who just won’t be persuaded. Let’s talk about how to handle them next.

What to Do If Patients Refuse

In an ideal world, all your patients would embrace your new credit card on file program and sign up right away! However, that rosy scenario isn’t always the case, and some patients are just never going to feel comfortable providing their credit card information to remain on file. How can you accommodate them -- and still make sure your practice gets paid?

First, make it a policy to handle these patients on a case-by-case basis. You want credit card on file to be the rule, not the exception.

As an alternative, you can ask a patient to pay within a certain time frame and have them sign an agreement to do so. Along these lines, you can also consider charging a finance fee if they don’t pay within the agreed-on time frame. Some practices waive the credit card on file requirement for patients who pay their estimated portion of the payment up front, so that’s also a possibility.

Another option is to agree to call a patient after you receive their EOB and let them know you plan to charge their card for the balance due in 24 hours unless they call with other instructions. This is time-consuming, though, so only do this for special cases. A better strategy is to have an automatic email option (HIPAA compliant, of course!) that notifies the patient of their responsibility after you’ve received the EOB and when you plan to issue the charge on their credit card.

Your last resort is to not accept as patients people who refuse to be part of the credit card on file payment program. Only you know the needs of your practice and your patients, so only you can decide whether this is a good course of action to take.

For an excellent example of a credit card on file program, check out what Short Hills Ophthalmology has done.4

Conclusion

Well, do you feel like you have the makings of a superhero for your practice now? With a credit card on file program, you have a great way to swoop in and save the day!

Just to review: The increasing number of high-deductibles and self-pays have created some diabolical collection problems for practices. But with your trusty credit card on file program, you can knock out outstanding patient balances, reduce accounts receivable time and save costs.

Remember, though, that proper implementation is the key to success!

- Make sure your program securely handles credit card data.

- Train your staff well and ensure that they’re comfortable talking to patients about it.

- Properly communicate the plan to your patients -- this is a must!

By keeping a credit card on file for each of your patients, you’re ensuring that your practice is paid for the valuable services you provide -- and that you can continue helping patients for many years to come!

Sources (provided by ACAAI):

- Sample Credit Card Authorization Form.

- Sample Credit Card on File Program Letter to Patients.

- Physicians Practice, "Sample Credit Card Authorization Policy Form for Medical Practices."

- Mary Pat Whaley, "Your Top 5 Credit Card on File Questions Answered."

- Short Hills Ophthalmology’s, "Credit Card on File Program."

Footnotes

- 1 Robin A. Cohen, Ph.D., and Emily P. Zammitti, M.P.H., "Credible Statistics on the Financial Barriers of High Deductible Health Plans."

- 2 Wills Tower Watson, "U.S. Employers Expect Health Care Costs to Increase 5.0% in Both 2016 and 2017."

- 3 Payment Card Industry Security Standards for Vendors.

- 4 Short Hills Ophthalmology’s, "Credit Card on File Program."

Facebook

Facebook X

X LinkedIn

LinkedIn Forward

Forward